Do corporates really view their real estate as playing a strong part in their carbon reduction strategies?

With 40% of global carbon commissions coming from real estate, business leaders acknowledge that addressing the challenge of sustainability makes strong business sense as well as offering a branding opportunity. Against this backdrop, we set out to discover the views and actions of office occupiers on sustainability and ESG, conducting a survey of almost 400 global corporate occupiers for (Y)OUR SPACE.

The results showed there was not a universal appreciation of the role real estate can play in carbon reduction strategies. Crucially, among businesses who did espouse a positive ESG focus, there was a clear gap between ambition and action.

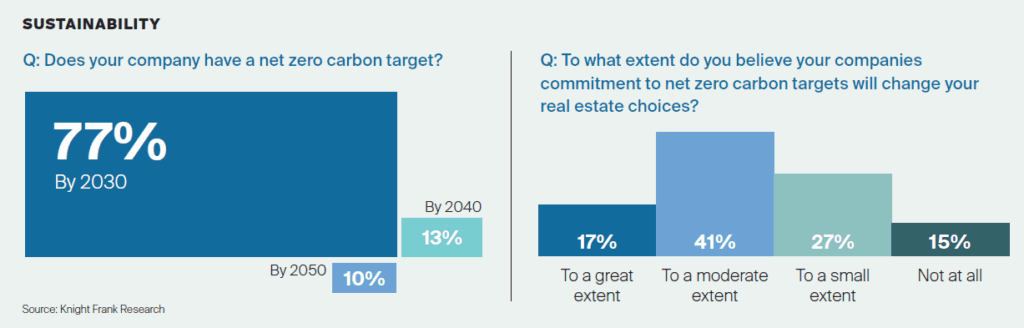

Of those corporates surveyed, 40% had a net-zero carbon target in place and 77% of that number had set an ambitious target date of 2030 – less than one real estate cycle from now. However only 16% of those surveyed believed their commitment to net-zero carbon fundamentally changed the way they make real estate decisions, while close to 60% had less than 10% of their global portfolios in accredited buildings.

The (Y)OUR SPACE survey confirmed that the office retained an important role in corporate life post pandemic and that occupiers acknowledged the need to control carbon emissions. Yet despite the desire to make a difference, the push for action was not materialising. There is some evidence that occupiers are now bringing requirements to market with minimum sustainability requirements and that searches are being led by sustainability leaders but these are the exception rather than the rule presently.

The continuing disconnect between wider corporate sustainability concerns and future real estate strategy highlights how occupiers lag behind investors in their appreciation of the importance of the ESG challenge. To build back better and play an appropriate part in fighting climate change, there needs to be improved education and a raised awareness among corporates along with a focus on bringing sustainable real estate into their portfolios.

Author:

Lee Elliott

Partner, Global Head of Occupier Research

More information you can find in the “Quantifying ESG in real estate: Six lessons from the journey so far”.