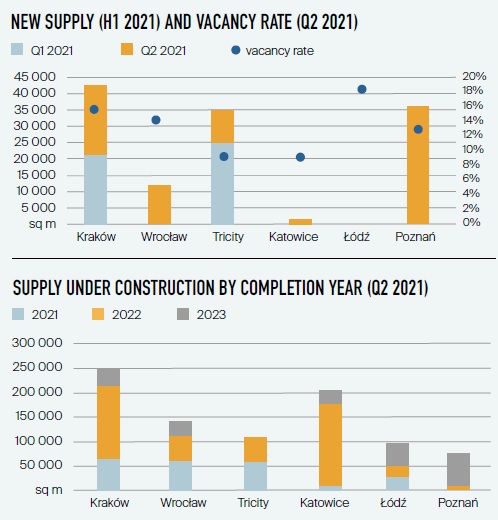

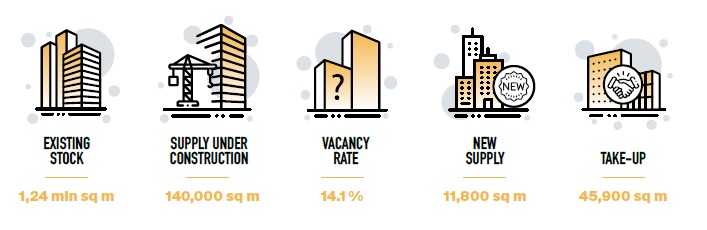

At the end of June 2021 total office stock in Wrocław reached 1.24m sq m, placing it the second largest office hub among regional markets. Developer activity weakened slightly in the capital of Dolny Śląsk. In the first six months of 2021, only one project was completed – Krakowska 35, offering 11,800 sq m. Caution among developers could also be observed in their approach to new investments. In H1 2021 only one planned project was started – the second phase of Centrum Południe by Skanska Property Poland – and 140,000 sq m of office space remains under construction. If developers keep to their schedules, approximately 40% will be delivered in 2021.

Compared to Poland’s other regional markets, tenants in Wrocław were relatively active – in Q2 2021 almost 24,400 sq m was subject to lease. During the first six months of 2021 tenants leased almost 46,000 sq m. In Q2 2021 approx. 50% of the take-up volume was in one pre-let agreement in MidPoint71, with renewals accounting for a further 30% of transaction volume.

The vacancy rate remains at a stable level – decreasing by 0.1 pp. compared to Q1 2021 and standing at 14.1%.

If you want to find more information about Wrocław, please have a look at the full report: https://reports.knightfrank.com.pl/strongcities_h12021