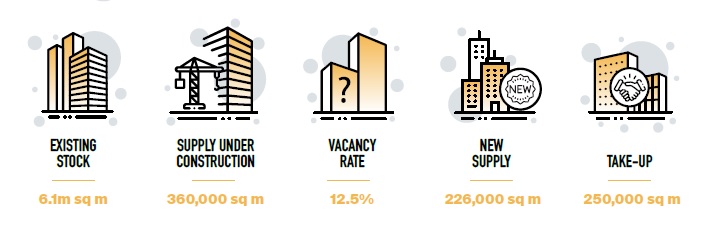

With the significant volume of new supply being delivered to the Warsaw market in H1 2021, the total stock of modern office space reached a level of almost 6.1 million sq m. Over this period, occupancy permits were granted to 10 office buildings with a total area of approx. 226,000 sq m. It is worth noting that 67% of this space was located in only 3 buildings: Skyliner (48,500 sq m, Karimpol Polska); the final stage of the Generation Park complex – building Y (44,200 sq m, Skanska Property Poland); Warsaw UNIT (56,400 sq m, Ghelamco). These three investments are all located in the vicinity of Daszyński Roundabout and as a result the office stock in this sub-area now stands at some 675,000 sq m.

It should, however, be remembered that the high level of new supply does not equate to increased developer activity. Projects started pre-pandemic are being constructed without delays, whereas many decisions to start new investments remain on hold until the pandemic is over and tenant activity is back to desired levels.

Currently, the volume of office buildings under construction, 360,000 sq m, is at the lowest level for a decade. More than 1/3 of this space is due for completion by the end of 2021 and, as long as developers complete construction works at previously set dates, this year’s new supply should approach the second highest result in the history of the Warsaw office market (behind 2016). Over 75% of the supply under construction is in the central business zones, which is unsurprising given that this is where the largest office towers are currently being built – including Varso Tower, the highest in the European Union (68,600 sq m, HB Reavis), and Skysawa, with its direct metro station connection (34,200 sq m, Polski Holding Nieruchomości).

In the second quarter of 2021, lease agreements for approximately 140,000 sq m were signed, and tenant activity in Q2 2021 exceeded the level recorded over the first three months of the year. The total volume of 250,000 sq m, however, is the lowest six-month result on the demand side in the last 10 years. In the first half of 2021, central zones were the most preferred by tenants. In the CBD and in the vicinity of Rondo Daszyńskiego, 60,000 sq m and 52,000 sq m were leased respectively. The Służewiec area ranked third in terms of take-up volume (almost 35,000 sq m).

New lease contracts and expansions accounted for almost half of the six-month take-up, although tenant interest in projects under construction declined significantly – the share of pre-lease contracts in total demand was only 11%. In the Warsaw office market tenants are still more willing to renegotiate existing contracts than they had been pre-pandemic. Extensions of existing agreements accounted for over 40% of the volume of space leased in the first half of 2021.

The visible decline in tenant activity and the high supply of new space (which was only 55% leased at the time of delivery) led to a further increase in the vacancy rate. After two years at levels below 10%, the vacancy rate at the end of Q2 2021 stood at 12.5%. The rate in Warsaw increased by 1.1 pp over the quarter, and by some 4.6 pp. compared to the corresponding period of 2020. This vacancy rate translates into almost 760,000 sq m of space available for immediate lease, of which almost 110,000 sq m is in investments completed in the first and second quarters of 2021. It should be remembered that the actual volume of space for rent is higher, as the market also contains space offered for sublet lease.

Despite the changing market situation, asking rents in the Warsaw market have thus far remained stable, although the beginning of 2021 has already seen slight corrections, in the region of EUR 0.5/sq m/month. These changes can be observed mainly in projects located in central locations. In the CBD rents fall within the range of EUR 20-25/sq m/month, although some prime office space on the top floors of the towers may command rents as high as EUR 27-28/sq m/month. In other central locations, rates ranged from EUR 15 to EUR 22/sq m/month. Asking rents in non-central locations range from EUR 10 to EUR 15/sq m/month. Due to the wide package of incentives on offer from landlords to potential tenants, even more so during the COVID-19 pandemic, effective rates remain approx. 20% lower than asking levels.

If you want to find more information about Warsaw, please have a look at the full report: https://reports.knightfrank.com.pl/strongcities_h12021